Introduction

Your client's company just landed a major international contract, opening doors to exciting new markets. As you help them dive into the logistics, you face a familiar challenge: calculating customs duties and landed costs is more complex than they anticipated. Suddenly, their profit margins seem less certain, and the risk of costly errors looms large. As an Odoo Integrator, you've seen many businesses grapple with the intricate world of international trade taxes, often finding themselves lost in a maze of harmonized system codes, varying duty rates, and ever-changing regulations. Let's explore solutions to help you tame this customs chaos and guide your clients through international waters with confidence.

[Rest of the content remains largely the same, with a few adjustments to maintain the perspective of addressing the Odoo Integrator]

Manual Customs Calculation and Spreadsheets

Many businesses use manual calculations and spreadsheets to manage customs duties. This approach involves:

- Maintaining a database of HS codes and duty rates

- Manually inputting product and shipment information

- Calculating duties and fees using spreadsheet formulas

Strengths:

- Flexible and adaptable to unique situations

- Low initial cost using existing spreadsheet applications

Limitations:

- Time-consuming for frequent international shipments

- Prone to human error, potentially leading to compliance issues

- Difficult to scale as business grows

- Challenging to keep up with changing regulations across multiple countries

Third-party Customs Management Software

Dedicated customs management software offers comprehensive solutions for international trade operations.

Key features:

- Databases of global trade regulations and HS codes

- Automated duty and fee calculations

- Tools for generating customs documentation

- Compliance management features

Strengths:

- Handles complex international trade scenarios

- Reduces time spent on managing customs duties

- Regular updates to reflect latest regulations

Challenges:

- Significant upfront investment in licensing and training

- Steep learning curve

- Integration with existing systems can be complex

- May lead to fragmented workflows if not well-integrated with other business operations

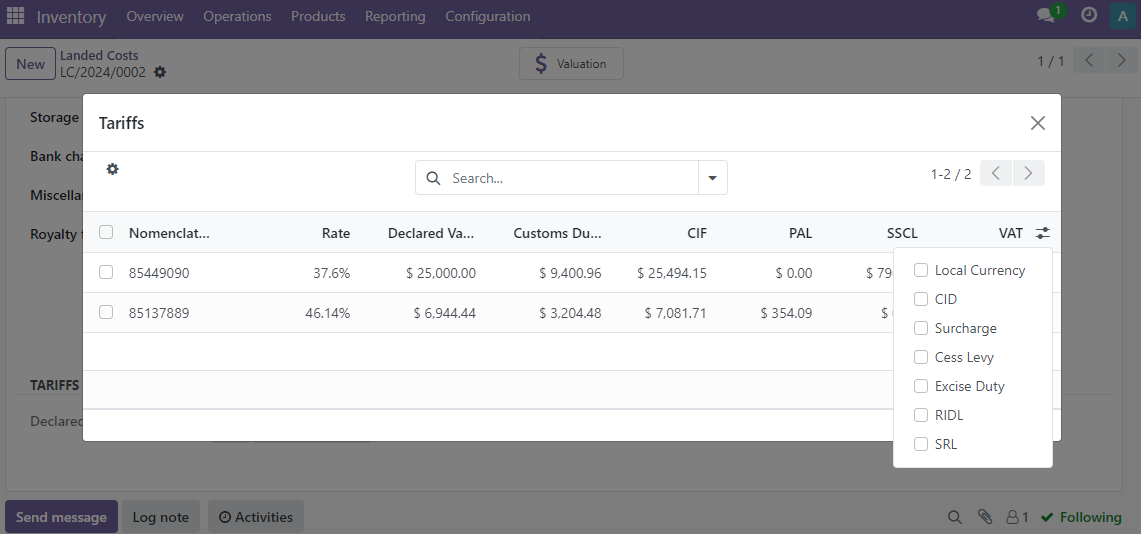

Customs Duties Add-on for Odoo Landed Costs

The Customs Duties and Shipping Fees for Landed Costs add-on, developed by Odoo Skillz, offers an integrated solution within the Odoo ecosystem.

Key features:

- Automated customs fee calculations based on HS codes

- Shipping fee management for import and export taxes

- Integrated landed cost calculations

- HS code database

- Customs VAT calculation

- Native Odoo integration

Benefits:

- Reduces manual input errors

- Streamlines workflow within Odoo environment

- Provides more accurate total landed cost calculations

- Potentially reduces implementation time compared to external systems

Note: This add-on may not offer the same depth of specialized features as some standalone customs management software.

Comparison of Solutions

Here's a comparison of the solutions :

| Criteria | Manual/Spreadsheets | Third-party Software | Customs Duties Add-on for Landed Costs |

|---|---|---|---|

| Ease of Use | Familiar but complex to maintain for large operations | Powerful with steeper learning curve | Integrates with Odoo, potentially easier for current users |

| Accuracy and Reliability | Prone to human error | Generally accurate with regular updates | Automates calculations, reducing manual errors |

| Cost Considerations | Low initial cost, time-intensive to maintain | Often requires significant investment | Moderate one-time cost, may require Odoo Enterprise |

| Integration Capabilities | Requires manual data transfer | May offer API integration, could require additional development | Native Odoo integration, limited to Odoo ecosystem |

| Customization and Flexibility | Flexible but time-consuming to customize | Often offers extensive customization | Customization possible within Odoo framework |

| Scalability | Challenging for complex operations | Generally scales well | Scales with Odoo, suitable for small to medium enterprises |

Conclusion: When to Recommend the Customs Duties Add-on

As an Odoo Integrator, you might find the Customs Duties add-on for Odoo Landed Costs particularly suitable for clients who fit these profiles:

- Odoo-Centric Operations: Businesses fully committed to using Odoo as their primary ERP system

- Small to Medium Enterprises: Companies outgrowing manual methods but not ready for comprehensive third-party solutions

- Moderate International Trade Volume: Organizations dealing with regular, straightforward international shipments

- Focus on Landed Cost Accuracy: Businesses prioritizing precise landed cost calculations

- Limited IT Resources: Companies without extensive IT teams to manage complex integrations

- Gradual Digital Transformation: Businesses looking to digitize customs management step-by-step

Consider your client's specific needs, future growth plans, and the complexity of their international trade operations when recommending a solution. The best option will align with their current needs and long-term business strategy, enhancing efficiency and accuracy in the global marketplace.

(Image prompt: Decision tree or flowchart helping Odoo Integrators determine which solution might be best for their clients based on the factors mentioned in the conclusion)

Ready to enhance your clients' customs management?

Explore how the Customs Duties add-on can streamline your clients' international trade operations. Our team is here to answer your questions and help you determine if it's the right fit for your clients' businesses.

Know more about our Customs Duties & Tariffs Add-on for Odoo

- Check our related posts:

- Schedule a demo to see the add-on in action : Contact US

- Customs duties add-on for Odoo Landed Costs